Which of the Following Is True Regarding Venture Capital Firms

VC investors have earned only a modest return over time E. Which of the following is true regarding Venture Capital firms.

The Great Battle Of The Venture Capital Industry Venture Capital Venture Capital Startups Business Proposal

VC is relatively riskless capital B.

. VC is relatively riskless capital b. Venture capitalists typically control about three-quarters of the seats on a start-ups board of directors. Asked Jun 11 2016 in Business by Gervin.

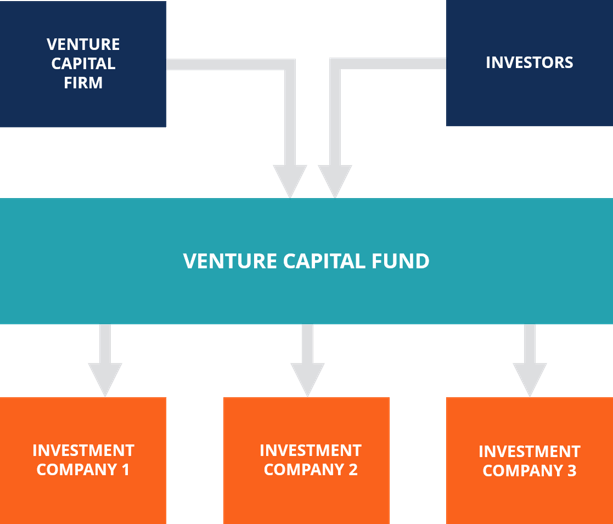

A A venture capital firm is a limited partnership that specializes in raising money to invest in the private equity of young firms. The initial capital that is required to start a business is usually provided by the entrepreneur herself and her immediate family. Most VC investments have a long time horizon of about 15 years.

Venture capitalists take on the risk of financing risky start-ups in the hopes that some of the firms they support will become successful. Angel investors focus on start-ups in their later stages whereas venture capital firms focus on low-potential start-ups. I II and in.

They are a source of debt financing for all large companies. Up to 25 cash back Answer VCs are always silent partners in the startup company that they finance VCs always have a majority of directors in the startup company VCs generally provide management advice and contacts in addition to capital All of the above statements are true of VCs. They prefer to back small firms with opportunities for fast growth.

A The general partners work for the venture capital firm and run the venture capital firm. Most VC investments have a long time horizon of about 15 years. Venture capital firms consist of 2 elements.

The initial capital that is required to start a business is usually provided by the entrepreneur herself and her immediate family. Venture capital VC is a form of private equity financing that is provided by venture capital firms or funds to startups early-stage and emerging companies that have been deemed to have high growth potential or which have demonstrated high growth in terms of number of employees annual revenue scale of operations etc. Capital gains distribution occurs when a mutual fund manager liquidates underlying positions that have made gains since they were added to the fund.

It is the money provided by an outside investor to finance a new growing or troubled business. They generally provide funds for start-up companies Select one. Question 2 Arrange the following in the chronological order for a.

I general partners also called venture capitalists who run the firm ii limited partners consisting mainly of institutional investors. C The initial capital that is required to start a business is usually provided by the. Venture capitalists typically control about three-quarters of the seats on a start-ups board of directors.

VC financing is available when a company issues its secondary offering E. They are usually established as limited partnerships III. VC firms generally invest in well-established multinational companies Answer.

The exit for most VC investments is an initial public offering d. B Venture Capital typically comes from institutional investors and high net worth individuals and is pooled together by dedicated investment firms. B Firms offer limited partners a number of advantages over investing directly in start-ups themselves as angel investors.

Venture capital firms may also supply a startup with business expertise that it lacks. VC investors have earned only a modest return over time e. IPOs backed by Venture Capital have higher than average first day returns B.

One way to distinguish yourself. Which of the following statements is FALSE. A venture capital firm is a limited partnership specializing in raising money to invest in early-stage companies often investing in many for diversification.

True Wealth Ventures is a two-partner seed-stage venture capital firm based in Austin looking to make our first full-time hire as we ramp up Fund IIThere are many work streams with which we require assistance so the role itself can be adjusted based on. I and III only d. They rely more heavily on business plans than on executive summaries in making investment decisions.

Venture capital firms get most of their capital from pension funds large university endowments and other institutions that can take substantial risks with a small portion of their funds. A They can provide substantial capital for young companies. Which of the following statements about venture capital firms is false.

Which of the following is true regarding Venture Capital firms. Which of the following statements is true concerning Capital Gains DistributionsSelect one. A venture capital firm is a limited partnership that specializes in raising money to invest in the private equity of young firms.

Venture capital firms or funds invest in these early. I only bI and II only c. Angel investors fund only nonprofits whereas venture capital firms do not fund nonprofits.

Capital gains distributions will be taxed as interest to the person receiving the distribution. Venture capital firms tend to be highly specialized and your answer must reflect that specialization. Upon successful IPO first round VC gets lower return than later stage VC C.

Angel investors include private organizations whereas venture capital firms include only government organizations. B An important consideration for investors in private companies is their exit strategy how they will eventually realize the return from their investment. They are called venture capitalists.

Which of the following statements is NOT true regarding venture capitalists. Only about 10 of VC investments go bust c. C When a company founder decides to sell equity to.

The exit for most VC investments is an initial public offering D. VC firms get positive returns from all their investments D. A venture capital firm is a limited partnership that specializes in raising money to invest in the private equity of young firms.

Venture capital firms will generally have access to one or several funds that they use to invest in startups and those funds are private equity funds that come from a variety of sources. Most start-up companies that acquire venture capital eventually turn out to be successes. B Venture capitalists typically control about three-quarters of the seats on a start-ups board of directors and often represent the single largest voting block on the board.

Which of the following is true concerning venture capital firms. They offer business expertise to firms for which theyve contributed capital II. Which of the following statements is true of venture capital firms.

Only about 10 of VC investments go bust C.

Venture Capital Features Types Funding Process Examples Etc

Comments

Post a Comment